Addiction can wreak havoc on every aspect of your life, including your finances. As you struggle to overcome the grip of addiction, it’s easy for bills to pile up and financial responsibilities to slip through the cracks. One consequence of this can be the threat of car repossession, which can further compound the challenges you are already facing.

Preventing car repossession during addiction requires proactive steps and a disciplined approach to managing your finances. It’s important to recognize the seriousness of the situation and take immediate action to protect your vehicle and stabilize your financial situation. In this article, we will explore some practical strategies to help you avoid car repossession while coping with the challenges of addiction.

Review Your Current Financial Situation

The first step in preventing car repossession during addiction is to take stock of your financial situation. This means assessing your current income, expenses, and any outstanding debts related to your vehicle. By gaining a clear understanding of where you stand financially, you can begin to develop a plan to address any past-due payments or other financial obligations.

Prioritize Payments

Once you have a clear picture of your finances, it’s important to prioritize your car payments to prevent repossession. This may mean cutting back on other expenses or seeking additional sources of income to free up money for your car loan.

Communicate With Your Lender

When it comes to preventing car repossession, communication is key. If you are struggling to make your car payments due to addiction-related challenges, it is important to reach out to your lender as soon as possible. Many lenders are willing to work with individuals who are facing financial difficulties, especially if they are proactive in addressing the situation. By being transparent about your circumstances and demonstrating a commitment to finding a solution, you may be able to negotiate a more manageable payment plan or explore alternative options to keep your car and avoid repossession.

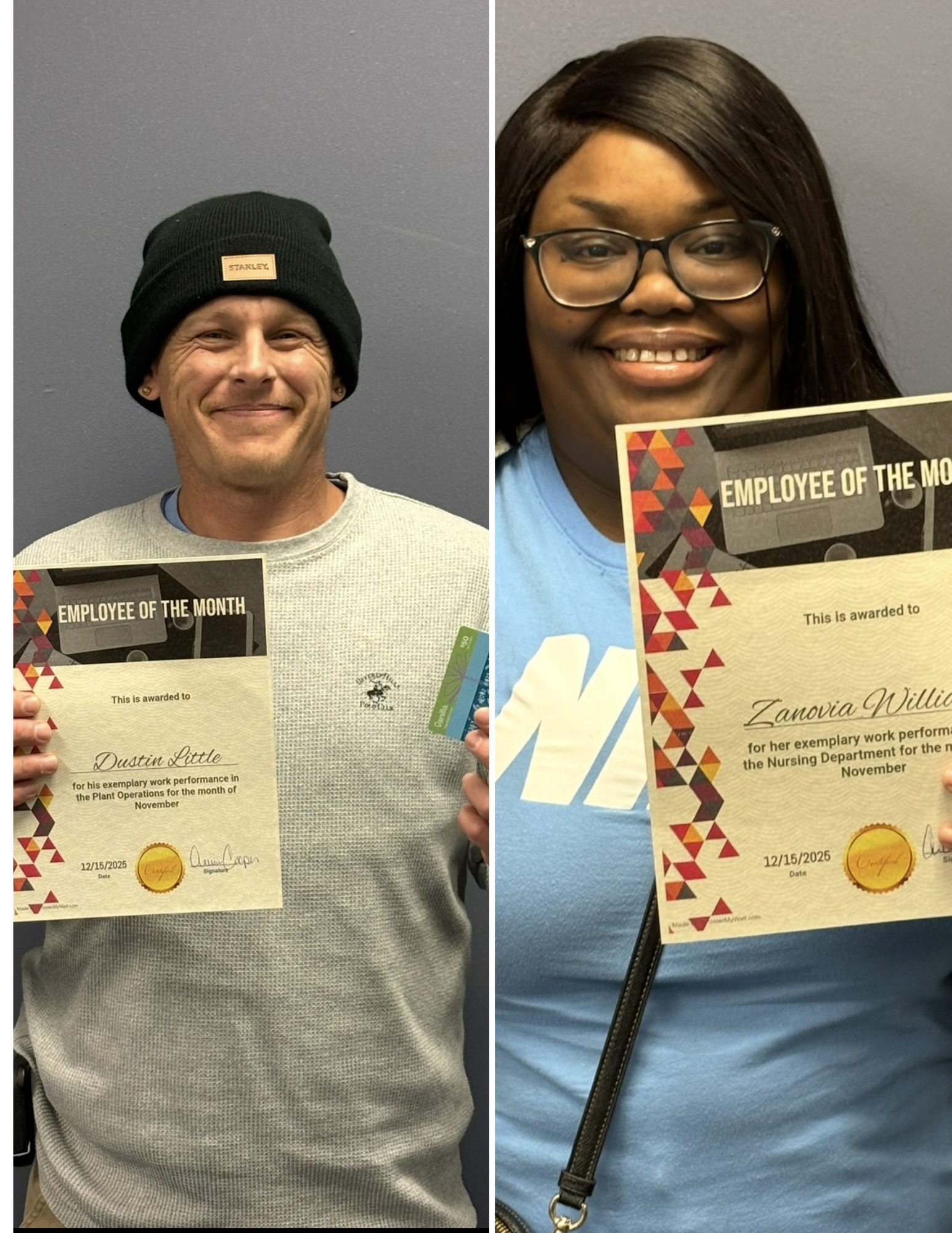

Contact Serenity Treatment Center of Louisiana

At Serenity Treatment Center of Louisiana, we understand the challenges that come with addiction and the impact it can have on various aspects of your life, including your finances. Our team is here to support you in your recovery journey and provide you with the resources and guidance you need to prevent car repossession and get back on track. Contact a member of our team by calling us at (225) 361-0899 or filling out our online form.